Understanding Medicare Part A in Virginia: Insurance Coverage for Hospital Related Services

Understanding Medicare Part A: Insurance Coverage for Hospital-Related Services in Virginia

As a senior citizen in Virginia, it's important to have a good understanding of Medicare Part A, which covers inpatient care received in hospitals, nursing facilities, and at home. This guide will provide you with everything you need to know about Medicare Part A, including eligibility requirements and associated costs.

Eligibility Requirements for Medicare Part A in Virginia

To be eligible for Medicare Part A in Virginia, you must be a United States citizen or a legal permanent resident of the USA for at least five consecutive years. You must also be either 65 or older, disabled, have end-stage renal disease, or amyotrophic lateral sclerosis.

Coverage for Hospital-Related Services under Medicare Part A in Virginia

Under Medicare Part A in Virginia, you will receive full coverage for hospital expenses that are critical for your inpatient care, including a semi-private room, nursing services, meals, medications included in your inpatient treatment, and other related services and supplies from the hospital. Part A also covers critical inpatient care provided through:

- Critical access hospitals

- Acute care hospitals

- Long-term care hospitals

- Mental health care

- Inpatient rehabilitation facilities

- Participation in a clinical research study

However, Medicare Part A does not cover the costs of a private room, your private-duty nursing, or your care items expenses such as shampoo, telephone, and television. It also does not cover the cost of blood. If the hospital gets blood from a blood bank, there are no charges. However, if the hospital purchases blood for you, you have to pay for the first three units that you will receive.

Costs of Medicare Part A in Virginia

Most people in Virginia do not pay a monthly premium for Medicare Part A Hospital Insurance coverage if they and their spouse paid Medicare taxes while working. However, if you are not eligible for premium-free Part A, you can buy it at an approximate cost of $458 each month. If you paid Medicare taxes for less than 30 quarters, the approximate premium is $458. If you pay Medicare taxes for 30-39 quarters, the approximate cost is $252. Part A hospital inpatient cost and co-insurance include a $1,408 deductible for each benefit period.

Co-insurance for Medicare Part A in Virginia includes:

- Days 1-60: $0 for each benefit period

- Days 61-90: $352 per day of each benefit period

- Days 91 and beyond: $704 per each “lifetime reserve day” after day 90 for each benefit period

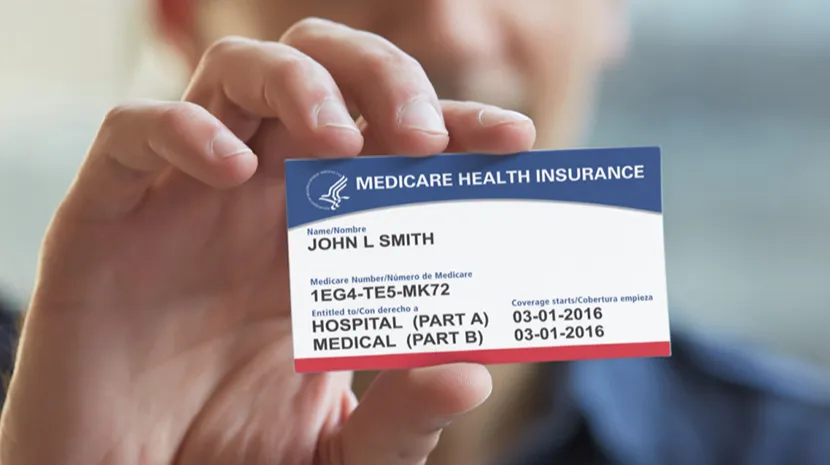

Enrollment for Medicare Part A in Virginia

You will automatically get enrolled in Medicare Part A in Virginia if you turned 65 and are receiving social security retirement benefits or railroad retirement board benefits. The best time to get a Medicare plan in Virginia is during your 6-month Medigap open enrollment period. You will get better prices and more policies. To be eligible for a Medicare supplement insurance Part A in Virginia, you must be age 65 or older and a U.S. citizen or a legal resident of at least five years, getting retirement benefits, disabled and getting disability benefits, or have end-stage renal disease or amyotrophic lateral sclerosis.

Paying for Medicare Part A in Virginia

There are four ways to pay your Medicare Part A premium in Virginia. You can pay online via your Medicare account, pay directly from your bank savings account, use Medicare Easy Pay, which is a free service that automatically deducts your premium payments from your savings or checking account each month, or mail a check to Medicare.

Conclusion

As a senior citizen in Virginia, it's essential to understand the details of Medicare Part A and what it covers. With the information provided in this guide, you now have a better understanding of eligibility requirements, coverage for hospital-related services, associated costs, and enrollment options. By taking advantage of this coverage, you can ensure that you receive the necessary care and treatment in the event of hospitalization or other inpatient care needs.